Lisa Caldwell, retired EY Americas business consulting leader, said it best in a recent ey.com article titled “What strategic operations means for your business” when she noted that supply chains should be “…the epicenter of operations driving integrated decision-making with business functions, from sales and marketing to product development, to finance, to procurement and manufacturing.”

Essentially, Caldwell is making the point that the supply chain is the connective tissue in a business; and, as such, companies need to be better at making those internal connections.

Couple that with the reality that shippers are being asked not only to do more with less, but also to provide distinctive capabilities, in accelerated time frames—and on limited budgets—in the face of the constant change in front of them across global value chains. The result is a direct need to rethink the current ways of working across both internal teams and external partners.

If done right, this will bring together all the necessary logistics ingredients to create a new recipe for success that, at its core, is leveraging the real power of shippers’ supply chains.

While this is certainly easier said than done, this type of “rethink” is critical to meet the ever-changing demands from customers—with certainty, agility and confidence—all while balancing the cost-growth equations to deliver value to both the top and bottom lines, with a constant pressure on speed to value.

Shippers, now more than ever, must reconsider and redesign their core logistics operating models to be inclusive of the talent and capabilities that third-party logistics (3PL) brings to the partnership. This can be supported by a recent report on the top 10 supply chain trends by the Association for Supply Chain Management that highlighted the trend to invest in systems and people—reflecting that supply chain leaders are already thinking about this critical topic.

In the April 2024 issue of Logistics Management, the article “Going deeper with 3PLs” shared that shippers needed to go deeper by shifting the transactional relationship to a more strategic partnership with their 3PLs, focusing on value, governance, performance, visibility and co-innovation.

Additionally, a Penske Transportation Solutions blog reflects the shift to more strategic shipper/3PL relationships by noting that “both shippers (62%) and 3PLs (87%) said shippers are increasing their use of outsourced logistics services, up from 54% and 81% last year, respectively.

However, there was an increase in the number of shippers that reported reducing or consolidating 3PLs, which grew to 78% from 71%. Among 3PLs, 84% agreed that shippers are reducing or consolidating 3PLs, a 9% decrease from last year.”

Considering the movement toward consolidation—while still focusing on those key areas noted above—creates an opportunity for a more strategic framework that allows these critical areas to be stitched together to gain the combinatorial value that comes from application of all efforts in concert with each other.

Shippers and 3PLs have always worked together as both have profit motives: the shipper needs its product in places where it can sell it to the demand needing it, while the 3PL provides those expert intermediary services to make that happen—earning some sort of fee.

While this seems to work and drives the economics of logistics for shippers and the 3PLs that serve it, there is a better way that provides a more seamless, connected and integrated model to improve the value for both, while keeping a laser focus on the customer.

A new logistics operating model

That better way is a refreshed logistics operating model (LOM) that’s strategically designed with the shipper/3PL partnerships in mind and focuses on the core mission of the shipper’s business to determine where and how the 3PL will support the strategic planning and execution of logistics.

The LOM, which is the framework by which the logistics functions carry out the route to market strategies that are inherited from and connected to the overall business strategy, gives both shippers and partners equal consideration when making decisions about where the processes, transactions and talent will take place to meet the shared value proposition and customer promise.

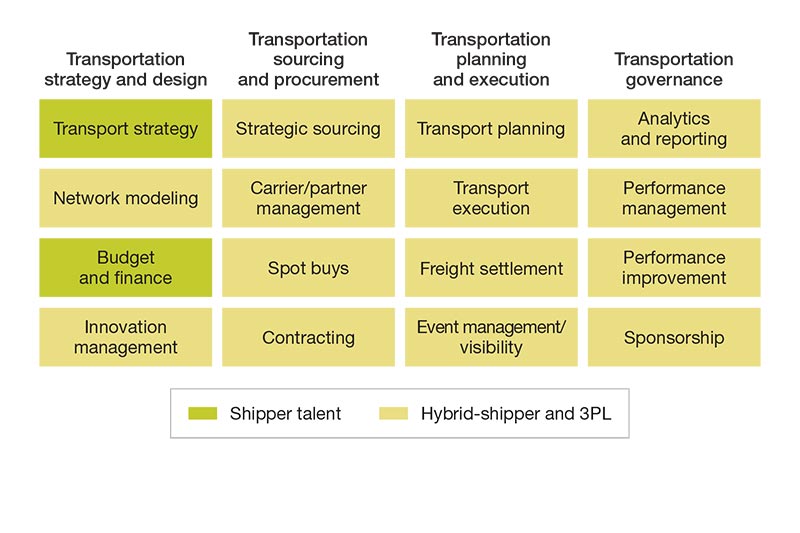

Areas where 3PLs are commonly leveraged across a sample of transportation categories

The chart highlights areas where there are common opportunities to consider the use of a 3PL to deliver on that capability need.

The basis of all LOMs should be anchored on the number “one.” One common framework to support the customer promise. One source of the truth for all partners and players in the ecosystem to make the most appropriate choice in the service provided. One team made up of internal and external resources. One connected platform that incorporates the myriad technology needed to drive the logistics engines. One set of guiding principles that continually adjusts to meet the needs of the customer.

Achieving that oneness requires that the shipper understands all the capabilities it needs to run a leading-class logistics function and the required level of maturity for each capability to meet the business need—while also being mindful of the costs to operate balanced against a certain speed to value.

The latter will require an honest appraisal of how each capability is executed today—compared with leading practices shared in the industry—to best understand the level of effort needed to move it to the right place on the maturity spectrum (note that not every capability needs to be leading class) given the gap identified to meet the future state goals and outcomes.

A common example that we have encountered with clients across industries is one where a shipper is evaluating its transportation capabilities as part of the LOM refresh and identifies a need to improve its overall sourcing capability based on the recommendations from the maturity assessment.

The initial capability design will focus on a multitude of considerations that need to be made when improving this area, such as: Should the talent be cultivated internally, or should a 3PL be engaged to provide talent? What technology is needed, and will it be provided by internal IT or provided as part of the service proposition from the 3PL partner? Where will the actual work take place? Will this be part of a broader center of excellence? And so on.

It’s a bit of a “choose your own adventure” where each decision gate opens new decision gates to fine-tune the capability need. And while this doesn’t seem to be too daunting given the example shared, this takes great care and precision to determine all the “right” answers for the shipper to deliver on the planned outcomes.

The previous example highlights the depth and breadth of the decisioning required for just one of the many, many capabilities that sit inside a complete LOM. It also reflects the nuances on where 3PLs are considered as part of a “one-team” mindset required to get it right.

This interwoven fabric of 3PL-shipper capabilities will then yield a hybrid model of internal and external resources, slotted together to create the unique shipper ecosystem designed to flexibly serve the demands of customers—at the “right” costs and required service levels.

From design to deliver

The LOM is really the strategic framework or matrix that connects all the people, processes and technologies—with applicable levels of governance and policy that are supported by critical analytics with the right data at the right time—organized in ways to execute on the business strategy.

As demonstrated in the example above, there are a multitude of questions to address when redesigning the operating model—with some key ones that every logistics organization will need to answer in order to understand how best to leverage a 3PL considering the speed to value, cost optimization, and strategic growth drivers. The graphic below lists some of those core questions.

To be clear, there is not a one-size-fits-all approach that can be applied globally; there needs to be balanced consideration for centralization, regionalization and localization to meet the entire spectrum of needs.

Building on the example listed above, we have seen ocean and air managed services shift from a business unit/decentralized activity to a centrally and globally led function, while over-the-road (OTR) modes were anchored to more of a regional model and even sub-regionally (country level) in places such as EMEA and APAC. Considerations like this will need to be made for all the capabilities within the refreshed LOM.

Operating model elements

Source: EY

Getting started

As complex as it may seem to redesign the entirety of the LOM with your partners in mind, it should be done with a lens of value prioritization such that those areas that will provide the fastest impact to the value proposition—whether that’s accretive growth to the top line or optimizing the costs that hit the bottom line—are prioritized first to potentially help fund the remainder of the LOM build.

Recent EY successes for two clients have helped to release more than $300 million in capital that is being reinvested into those shipper value chains to build the future capabilities needed to keep and grow their market share.

This tends to happen quite often in logistics operations, where the “low-hanging fruits” are identified to quickly reduce overall costs, releasing capital back into the business that could be used to invest in the organization’s strategic growth.

In fact, it is a leading practice to follow this path when designing a new LOM to achieve both the cost optimization and strategic growth goals and objectives — ushering in a new transformative power, a “transport-mation” so to speak, that is needed to win in the market today.